From Criticism to Record Loans

Interim Govt’s Foreign Debt Hypocrisy Exposed

Bangladesh’s external debt has reached an all-time high, sparking heated debate over the government’s economic strategy and exposing contradictions in its political stance.

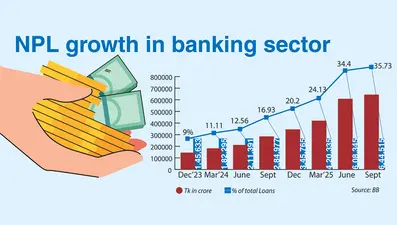

According to Bangladesh Bank’s latest data, total foreign debt stood at $112.16 billion at the end of June 2025, up by $7.35 billion in just three months. The majority of this increase came from the public sector, while private sector borrowing saw a slight decline due to currency depreciation and sluggish new investments.

In June alone, Bangladesh secured over $5 billion in loans from development partners, including the IMF ($1.3 billion), World Bank, ADB, AIIB, and Japan. Much of this financing was provided as budget support, directly swelling the government’s foreign debt portfolio.

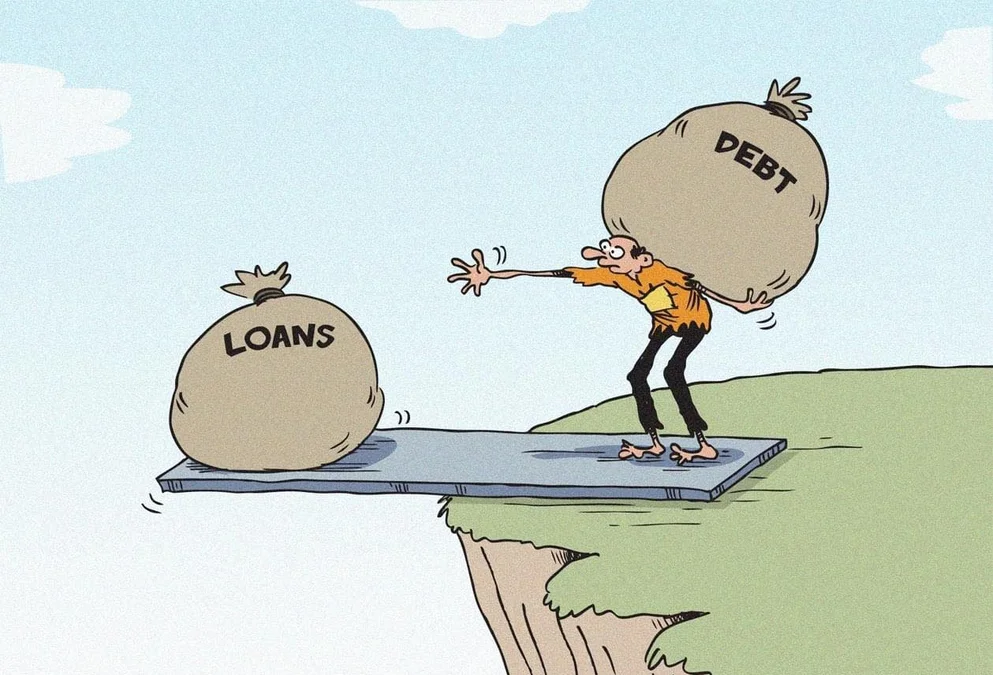

Economists warn that the rising debt burden could become unsustainable if not carefully managed. Dr. Mustafizur Rahman, Distinguished Fellow at the Centre for Policy Dialogue (CPD), cautioned: “High interest rates and shorter grace periods are increasing risks. Each project must be rigorously evaluated to ensure effective returns.” Former World Bank Chief Economist Dr. Zahid Hussain echoed similar concerns, stressing that loans directed to unproductive sectors would impose heavy repayment pressures on the economy.

This sharp surge in borrowing has also exposed political contradictions. During the Awami League government, many of today’s policymakers, then in opposition, had strongly criticized dependence on foreign loans, warning of intergenerational debt and wasteful projects. Now, just months into office, they have themselves contracted a record level of new loans contradicting their earlier rhetoric.

Bangladesh Bank figures show that by June 2025, public sector foreign debt climbed to $92.38 billion, up from $84.92 billion in March. In contrast, private sector debt fell to $19.77 billion, reflecting investor reluctance to borrow amid a weakening taka and subdued market conditions.

The surge in loans also contributed to a rise in official reserves, which stood at $31.77 billion in June. However, analysts note that much of this “reserve build-up” comes from borrowed dollars likening it to “showing the same crocodile’s child multiple times,” a Bangla idiom for deceptive accounting.

Measured in per capita terms, foreign debt now equals $638 per person, or 77,433 taka (at an exchange rate of 122 taka per dollar). This marks a steep rise from previous years and underscores the growing financial burden on citizens.

Economists emphasize that unless loans are channeled into productive sectors such as export-oriented industries and infrastructure that generates economic returns. Bangladesh risks weakening its economy under the weight of repayments. Political analysts add that the current administration’s borrowing strategy reflects a clear policy U-turn, undermining its earlier position and intensifying public criticism.