30% Default Loans in Standard Bank, Future Uncertain Amid Father–Son Conflict

Standard Bank has fallen into a severe crisis. The Shariah-based bank’s default loans have reached almost one-third of its total loans. At the same time, a power struggle between father and son in the boardroom has escalated to such a level that the bank’s future operations have become uncertain.

The bank’s chairman, Mohammad Abdul Aziz, and his son, vice chairman AKM Abdul Alim, are now positioned in two opposing camps. The main dispute centers on whether the current Managing Director (MD) Md. Habibur Rahman will remain in his position. Alim’s faction claims that Habibur Rahman was involved in loan fraud during his tenure at Union Bank. They have demanded his removal and have written twice to Bangladesh Bank.

However, the central bank has rejected their request. According to Bangladesh Bank, the allegations have not been proven, so the MD cannot be removed. On the other hand, the chairman’s faction says Habibur Rahman is innocent and that the opposing group is disrupting the bank’s normal operations.

Alim’s faction alleges that multiple cases are pending against the MD at the Anti-Corruption Commission. They also claim he has dismissed nearly 100 employees and brings police to board meetings. Meanwhile, MD Habibur Rahman says he was not involved in any loan irregularities. Rather, Alim’s group wants him removed because he did not cooperate with their “unethical activities.”

Chairman Aziz makes the same claim. He says that if the MD had committed any wrongdoing, Bangladesh Bank would not have allowed him to remain in his position. He further alleges that the opposing group wanted to install their own people in exchange houses in London and the United States, which would have caused major losses for the bank.

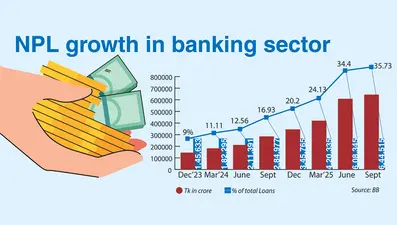

Standard Bank was established in 1999 and transformed into a fully Shariah-based bank in 2021. But its current financial condition is fragile. At the end of 2024, the bank’s default loans stood at Tk 5,968 crore, which is 29.3 percent of its total loans. Four years earlier, this rate was only 4.8 percent.

In 2023, default loans amounted to Tk 1,379 crore. Within a year, the amount increased several times. At the end of 2024, the bank’s total deposits stood at Tk 20,125 crore and total investments at Tk 20,361 crore. MD Habibur Rahman claimed that they have been able to reduce default loans by around Tk 900 crore in recent months.

Bangladesh Bank has stated that they are closely monitoring the entire issue. In a previous inspection, various irregularities committed by former chairman Kazi Akram Uddin Ahmed and his son, former director Kazi Khurram Ahmed, were detected. These irregularities contributed to the bank’s financial deterioration. After political changes, they stepped down from the board.

Regarding the current dispute, Bangladesh Bank spokesperson Arefin Hossain Khan said that an investigation against the MD is ongoing, but the allegations have not been proven. He warned that internal conflicts among directors could further worsen the bank’s financial condition.

Former professor of Chittagong University and economist Moinul Islam said such conflicts are common in the boards of many private banks. Directors prioritize their personal interests, causing the banks to deteriorate rapidly. In his view, the central bank should intervene quickly.

The financial crisis and boardroom conflict at Standard Bank have turned it into a symbol of the trust deficit in the country’s banking sector. Rising default loans and internal disputes among directors are making the bank’s future even more uncertain. Analysts say that if a quick solution is not found, the bank’s situation will further deteriorate.