IMF Warns

Weak Policies of Yunus Government Put Bangladesh Economy at Serious Risk

The International Monetary Fund (IMF) has issued a sharp warning that Bangladesh is now facing major macro-financial risks due to the weak revenue collection of the incumbent interim government, an inefficient financial sector, and persistently high inflation.

In a statement published on its website, the institution directly indicated that Bangladesh’s economy can no longer withstand the weight of its vulnerabilities.

At the end of a 13-day review mission from 29 October to 13 November—led by Chris Papageorgiou—the IMF stated that the lack of policies and prolonged delays in reforms are intensifying the current crisis.

In their words, unless strong, comprehensive, and effective policies are taken immediately, Bangladesh’s economy will become “entangled in a new web of risks.”

The institution’s assessment is extremely alarming:

• Amid such political uncertainty and disrupted production, GDP growth in FY2024–25 has collapsed to 3.7 percent.

• Even though inflation has fallen from double digits, remaining stuck at 8 percent is itself a sign of crisis—indicating that despite policy tightening, the pressure on ordinary people’s livelihoods has not eased.

Mission chief Papageorgiou acknowledged that the government has taken certain tightening measures in fiscal and monetary policies to control inflation and restore external balance. He also mentioned that reserves have begun to rebuild following exchange rate reform.

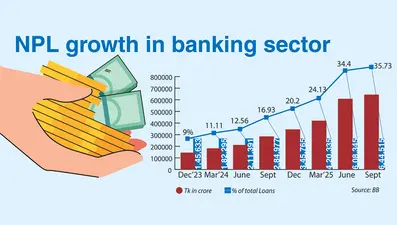

However, he revealed a harsher truth—that the weak tax collection system and capital shortfalls in the banking sector remain major risks for the country.

The IMF’s direct warnings are even stronger:

• Growth will fall further if banking sector reforms continue to be delayed.

• There is a risk of inflation rising again.

• Macroeconomic stability will be “severely compromised.”

The organization’s forecasts paint a bleak reality: if policy reforms are implemented swiftly, growth might rise to at most 5 percent in FY2025–26 and FY2026–27—meaning that even after tackling the crisis, growth will not return to its previous trajectory.

Though inflation may fall to 5.5 percent in FY2026–27, the IMF warns it could still remain as high as 8.8 percent in 2026.

Holding the government responsible for prolonged revenue shortfalls, the IMF stated that without ambitious tax reforms, no additional spending will be possible in the social sector or infrastructure. To address this, the IMF proposed: removing reduced VAT rates; withdrawing unnecessary tax exemptions (except for essential goods and services); increasing minimum turnover tax for all entities; and ensuring efficiency and transparency in tax administration.

Comments on the banking sector were even tougher. The IMF said that a coordinated government strategy is now an urgent requirement to address weak banks, including recapitalization, developing a plan for government support, reforming the legal framework, and identifying sources of necessary financing. It also emphasized asset quality reviews for state-owned banks, fixing governance issues, enhancing transparency, and strengthening loan recovery.

Overall, the IMF’s assessment makes it clear that the lack of long-term reforms, political instability, weak revenue mobilization, and irregularities in the banking sector have pushed Bangladesh’s economy into an inevitable zone of complex risks.

According to the institution, without improving governance, reducing youth unemployment, and diversifying the economy, the country will not be able to maintain stable medium-term growth.

The IMF’s warning essentially reflects a clear and harsh verdict on Bangladesh’s long-standing policy failures.