Bangladesh Faces Economic Risk Amid Surge in Non-Performing Loans

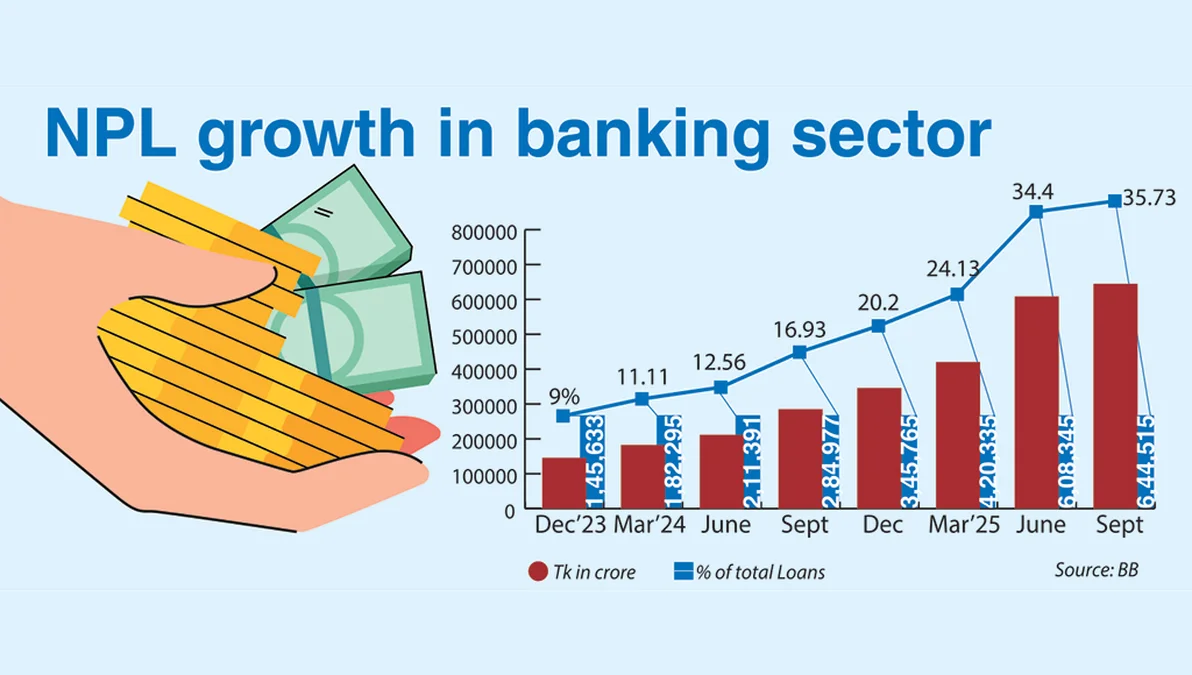

As of September, Bangladesh’s banking sector is grappling with an alarming Tk 6.45 lakh crore in non-performing loans (NPLs), posing a serious threat to the economy, slowing job creation, and ultimately transferring the cost of financial failure to the public.

The figure, revealed after stricter inspections and tighter loan classification rules, accounts for 35.73 per cent of all loans in the sector, placing Bangladesh among the countries with the highest NPL ratios globally.

Data from Bangladesh Bank shows that toxic loans increased by nearly Tk 3 lakh crore in just nine months from December 2024, when NPLs stood at Tk 3.45 lakh crore. A year earlier, in September 2024, the figure was Tk 2.85 lakh crore, meaning the volume has nearly tripled within twelve months as previously concealed defaulted loans surfaced.

Economists warn that the impact will be felt across the economy. Mizanur Rahman, professor of accountancy and public policy at Dhaka University, described the massive volume of bad loans as an “active volcano.” He cautioned that it threatens the savings of millions and could trigger a major economic crisis, as the government may need to inject funds into crisis-hit banks.

“There are no easy fixes,” he said, noting that the financial damage from bad loans would be substantial. “Banks’ lending capacity is severely limited due to such high amounts of NPLs. This hinders investment by both businesses and the government, causing widespread economic disruption.”

While Mizanur acknowledged that the interim government, which assumed power on August 8, 2024, had made some progress in managing the situation, he emphasized that a full overhaul of the country’s political and economic systems is required.

When the Awami League came to power in 2009, the NPL amount was Tk 22,481 crore. Experts assert that massive sums of defaulted loans were concealed through data manipulation, regulatory forbearance, and frequent rescheduling during the AL regime, which was ousted on August 5, 2024, amid a student-led uprising.

According to World Bank data, only a few distressed economies such as Equatorial Guinea, San Marino, Ukraine, and Chad have recorded NPL levels exceeding 30 per cent in recent years, putting Bangladesh far above regional benchmarks.

Mustafizur Rahman, distinguished fellow at the Centre for Policy Dialogue, stated that an organized syndicate siphoned enormous amounts of money from the banking sector, leaving banks weaker and less able to lend, which in turn increased interest rates and borrowing costs for businesses. He added that while the central bank is taking measures to address the issue, it will take considerable time for the sector to recover.

State-owned banks are carrying the heaviest burden, with nearly half of their loans classified as non-performing. Private commercial banks show around 34 per cent, while foreign banks remain comparatively stable at below 5 per cent.

Economists warn that manufacturing expansion, SME financing, and employment growth are likely to weaken further due to the high volume of defaulted loans. Higher provisioning will reduce profitability and increase risks for depositors, while taxpayers ultimately bear the cost when state banks require recapitalization.

The crisis is attributed to years of politically influenced lending, repeated rescheduling, weak recovery actions, and suppression of accurate financial data under the previous government. Since August 2024, many enterprises connected to the former patronage network have scaled back operations or ceased repayments, further contributing to the surge. Recent political unrest and slowing economic activity have also strained borrowers’ capacity to service debts.

Reforms in loan classification have accelerated the recognition of defaulted loans. The period before a loan is classified was reduced from 270 days to 180 days in September 2024 and then to 90 days in April 2025, aligning with international standards. Under the current rule, loans are classified immediately after an installment expires.

Source: New Age