Bangladesh Now Has the Highest Non-Performing Loan Rate in the World

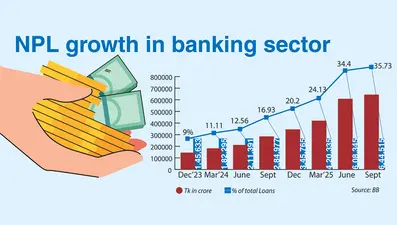

Bangladesh’s banking sector is currently facing an unprecedented crisis. As of the end of September this year, nearly 36 percent of bank-distributed loans have become non-performing. According to the latest data from Bangladesh Bank, the volume of non-performing loans (NPLs) stands at 644,515 crore taka. In just nine months, NPLs have increased by nearly 300,000 crore taka, an extraordinary rise in the country’s history.

Analysis of data from central banks and research institutions around the world shows that Bangladesh now has the highest rate of non-performing loans globally. War-torn Ukraine has an NPL rate of 26 percent, Lebanon less than 24 percent, and Russia only 5.5 percent. In contrast, Bangladesh’s NPL rate has reached 36 percent. Among South Asian countries, Sri Lanka’s NPL rate is 12.6 percent, Pakistan’s 7.4 percent, India’s 2.3 percent, and Nepal’s 4.4 percent—making Bangladesh’s position alarming by comparison.

The rate is also far lower in other Asian economies. Singapore’s NPL rate is 1.3 percent, Malaysia’s 1.4 percent, Thailand’s 2.7 percent, the Philippines’ 3.3 percent, Vietnam’s 5.4 percent, and Indonesia’s 2.1 percent. In China—the world’s second-largest economy—the rate is only 1.5 percent, and in the United States 1.7 percent.

Bangladesh Bank has stated that the NPL rate is now at its highest in 25 years. When the Awami League government came to power in 2009, total non-performing loans stood at just 22,000 crore taka. Over the past 15 years, irregularities, corruption, rescheduling, and restructuring allowed NPLs to remain hidden, but the true picture has now emerged.

The central bank says many loans previously classified as non-performing were not disclosed. Under international standards, loans are now classified as defaulted if installments remain unpaid for three months, which has revealed the actual NPL volume. Bangladesh Bank spokesperson Arif Hossain Khan said, “Banks used to sweep bad loans under the carpet. Now the real picture is coming out. We hope NPLs will decline in the future.”

Economists warn that this level of non-performing loans poses severe risks to the banking sector. Since loans are disbursed using depositors’ money, rising NPLs have caused provisioning shortfalls to surge. As of September, the provision shortfall of banks reached 344,000 crore taka, doubling within six months. This means banks are unable to maintain the required safety buffers against loan defaults.

Economist Dr. Mustafa K. Mujeri believes the government and Bangladesh Bank have failed to take strict action. He said, “If a few willful defaulters had been given exemplary punishment, others would learn. But such measures have not been seen.”

Syed Mahbubur Rahman, Managing Director of Mutual Trust Bank, said, “It is not surprising that the NPL rate has crossed 35 percent. Some banks had been concealing information for years. Now the real picture is visible.” He believes realistic measures must be taken to reduce NPLs and revitalize the economy.

Bangladesh Bank has already initiated some reforms. Boards of at least 14 private banks have been dissolved. Management changes have been introduced in state-owned banks. Five Shariah-based banks are being merged into one. However, economists argue that these measures are insufficient.

Overall, Bangladesh’s banking sector is now in deep crisis. The fact that the NPL rate is the highest in the world poses a serious threat to the country's economy and financial stability. Without swift and effective reforms, strict oversight, and punitive action against those responsible, the crisis cannot be resolved.