IMF Freezes Loan: No Confidence in Yunus-Led Unelected Government

The International Monetary Fund (IMF) has withheld further disbursement of its loan package to Bangladesh, citing the absence of an elected government. This move is seen as a strong message of no confidence in the interim administration led by Muhammad Yunus, which came to power following the violent political unrest of July.

The IMF had approved a total loan package of $5.5 billion, including a recent $800 million addition to the original $4.7 billion deal. However, only $3.6 billion has been released to date. The remaining funds are now suspended, with IMF officials reportedly raising concerns about transparency, misuse of funds, and the lack of democratic legitimacy in the current administration.

The so-called interim government, installed with the backing of the military and led by Nobel laureate Muhammad Yunus and his advisory council, has failed to gain international recognition. Despite initial assumptions that development partners would support the new regime, the IMF’s decision signals otherwise.

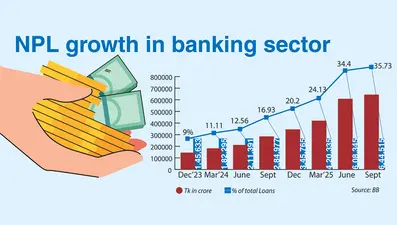

Economic indicators paint a grim picture. Bangladesh’s foreign reserves continue to decline, inflation is at record highs, and the cost of living is rising rapidly. Meanwhile, critics accuse the current government of lacking any economic direction, focusing instead on maintaining power and allegedly facilitating corruption and money laundering.

Sources familiar with the IMF’s internal assessments suggest that the fund now believes further disbursements would risk enabling financial irregularities. The IMF, known for its strict monitoring and accountability measures, has reportedly received credible intelligence indicating possible misuse of funds under the current regime.

Bangladesh Bank officials returning from Washington confirmed that discussions with the IMF had stalled, casting doubt over the future of the remaining loan tranches.

The IMF’s decision follows a pattern observed in other countries where unelected or military-backed governments led to aid freezes—examples include Myanmar, Egypt, and Thailand. Economic pressure has long been the international community’s first response to undemocratic regime changes.

Although some foreign diplomats have maintained a neutral or cautious public stance, financial institutions like the IMF remain numbers-driven. With weakening economic performance and an uncertain political climate, the fund appears unwilling to take further risks.

Analysts believe this freeze will deepen Bangladesh’s economic crisis, accelerate depreciation of the taka, increase import costs, and worsen inflation. The burden will likely fall on ordinary citizens, while the government continues to face growing domestic and international pressure.

The IMF’s stance sends a clear message: until a democratically elected government takes office, Bangladesh will not receive additional financial support from the fund. This marks a significant blow to the Yunus-led administration and a signal that international institutions are distancing themselves from regimes that lack democratic legitimacy.